Why Is Insulation Key to Energy Regulation Compliance

Why Is Insulation Key to Energy Regulation Compliance

Is Today’s Insulation Make-or-Break for Your Energy Compliance—and Why Are Owners Paying Real Attention?

Step inside the UK property market for a moment—where ticking the right boxes is no longer just about avoiding fines, but about keeping assets in play, keeping tenants happy, and beating competitors to the best rates, tenancies, and grants. For homeowners, landlords, agents, and commercial asset holders, the insulation issue isn’t background noise; it’s the lever that can tip your entire strategy from “legally risky” to “future-ready.”

Ignore insulation, and you risk seeing your property fade out of the market without warning.

Let’s call it straight: regulations don’t move backwards, and the insulation “bar” keeps rising. The days when you could instal a flashy new boiler or smart thermostat and call your property “green” are over. Energy Performance Certificates (EPCs) and the Minimum Energy Efficiency Standards (MEES) have redrawn the map— insulation is the qualifying round. Lenders, councils, and letting portals all demand proof, and tenants increasingly see insulation as non-negotiable comfort.

Anyone who still thinks insulation is “nice to have” is about to hit a wall—either in the form of legal frustration, soaring running costs, or delayed sales and lettings. The forward thinkers turn insulation from a liability into their property’s insurance—legal, financial, and competitive.

Melt the Doubt Away: Why Insulation Isn’t Optional Anymore

Gone are the days of “if.” Today, if your insulation doesn’t meet code, your entire business model or family investment is at risk. Surveys by the Energy Saving Trust show that lacking or poorly documented insulation undermines more EPC audits than faulty heating systems or windows combined. The market has shifted: insulation is frontline compliance— everything else comes after.

Regulators don’t care if your radiators are shiny. They care if your energy is leaking out the walls.

For every landlord, property manager, or owner facing their next audit, it isn’t just about passing. It’s about unlocking better mortgage rates, avoiding void periods, getting premium rents, and protecting resale value without last-minute panic.

Can Upgrading Insulation Unlock Real Returns—or Is It Over-Advertised Hype?

Every landlord and homeowner has heard upgrade pitches. But what does the evidence say about insulation specifically—can it actually rescue a mediocre EPC, increase property value, and stop tenants from walking?

The answer is yes—insulation ranks as the number one intervention for boosting both EPC scores and day-to-day property value. Government data reveals that over 90% of EPC compliance failures in 2023 were due to insulation flaws or missing documentation (lettingsdata.co.uk). Roof, wall, and floor insulation isn’t just price protection—it’s future protection, able to shift a “liability” property up two bands or more (gov.uk/epc-improvements).

Let’s flip the myth—your boiler can’t save you if your insulation is leaking money 24/7.

Compare the impact:

- Cavity wall/loft insulation: Can bump EPCs by two bands, slash energy loss by up to 58%, and save hundreds annually in bills.

- Boiler rejuvenation or stat upgrades: Often earn superficial EPC points unless the fabric is first airtight and insulated.

No shortcut wins, no gadgets and gizmos—get the insulation right, and everything else you invest in actually works.

The Cost of Delay—and the Value of Action

For property owners and managers, the “cost” isn’t just compliance. Every void period, every rejected application, every time a property sticks unsold is real money lost:

- Void periods due to non-compliance: Average loss exceeds £1,200–£2,500 per quarter per property.

- Failed grant or mortgage applications: Missed finance windows can push annual ROI down by double digits.

- Energy savings: The Energy Saving Trust sets the savings for standard homes at £285–£540 per year (2023).

Today’s insulation spec is tomorrow’s rent insurance, grant ticket, and stress-reliever—all wrapped up in one.

What Parts of a Property Need Insulation to Satisfy “Modern” Regulations?

Energy compliance isn’t a box-ticking exercise—it’s a multilayered game with real science, varying standards, and zero margin for fudge.

Walls, roofs, and floors are your non-negotiables.

- Walls: 30%+ of heat escapes here in uninsulated homes. Modern requirements (U-value under 0.18 W/m²K) mean 90–110mm of quality cavity fill is the new normal.

- Lofts/Roofs: Go under 270mm of mineral wool or proper rigid board at your peril—Part L expects it, and any shortcut is visible on thermal imaging.

- Floors: Need at least 65mm board and airtight perimeter seals to hit compliance. Floor upgrades are not “nice extras”—they’re core for both EPC and grants.

- Windows: Focusing only on glass misses the point. Substandard surrounding insulation undermines even the best glazing.

The only difference between a certified and a risky property is usually found in 10mm gaps, missed corners, or patchy documentation.

When it comes to documentation, there’s no “close enough.” Photos, certificates, and proof are what unlock compliance—every time. Skipping this step means having to redo work later, often in a scramble when lenders or letting agents ask the hard questions.

Unique Situations—What Owners Need to Watch

Holding a portfolio of 1960s bricks, a Victorian conversion, or a 2010s new-build? The principles are the same, but the compliance moves are different:

Every property type has its own insulation playbook—what gets an old terrace through an audit will fail a timber-frame new-build.

Owners and managers need to stay sharp and apply the regulation or miss out when the next deadline (or funding cycle) shifts.

Are All Insulation Materials and Methods Treated Equally by UK Law and Auditors?

Here’s where attention to detail really pays. It’s not enough to “add insulation”—the type, depth, installation quality, and documentary trail matter at every audit and letting stage.

Acceptable methods vary based on property age, wall/floor/roof type, and retrofit versus new build:

- Cavity Walls: Only TrustMark/PAS2030 certified blown fibre or beads. No DIY rolls or partial fills.

- Lofts: Minimum 270mm, layered above any boards or storage. Compression or “loose” rolls cut compliance.

- Floors: Proper insulated boards (≥65mm), up to the edges, with proof of airtightness.

- Party Walls & Flats: Must close thermal bypasses and avoid cold bridge ‘short circuits’ that penalise your EPC.

Documentation is not optional.

- TrustMark, PAS2030, or direct manufacturer’s certificate: Required for any work touching grants, audits, or future lending scrutiny.

- Thermal photos and installer ID: Now best practice and increasingly demanded.

It’s not who you know but what you can prove that keeps your property market-ready.

Relying on non-compliant, undocumented, or “home-rolled” insulation undercuts the entire investment—and lenders, buyers, and agents are more vigilant than ever.

Commercial vs Residential: What’s Different?

Commercial stock and large blocks face even tighter scrutiny, especially on external wall systems, flat roofs, and refurbishments. The game is “audit first, comfort second”—cut corners and you risk letting bans and grant blacklists.

What Are the Financial Penalties and Operational Risks of Neglecting Insulation Standards?

Failing to meet modern standards triggers a cascade—not just one fine or warning.

- Letting bans: If your property doesn’t meet current (and future-raising) EPC cut-offs, it’s automatically frozen out of letting and new finance windows.

- Civil penalties: Fines up to £5,000 per property for non-compliance. Not per building, but per landlord, multiplying multi-asset headaches.

- Grant and mortgage lockouts: No compliant insulation equals instant rejection from most green mortgage products and virtually all grant schemes.

- Devaluation at sale: Buyers now demand and negotiate based on insulation and EPC—subpar units stagnate or drop in value.

- Maintenance and void costs: Uninsulated or undocumented properties suffer higher repair bills long-term due to damp, tenant churn, and even legal costs from health or compliance complaints.

90% of EPC failures in 2023 were due to insulation gaps—not tech, not age, not lack of effort. *(lettingsdata.co.uk)*

Neglect doesn’t just risk a one-off slap on the wrist—it puts your entire cash flow and investment case up for jeopardy.

For Agents and Managers: Compliance Scales with Risk

Managing portfolios or acting for other owners? Each uninsulated, unproven property increases long-term risk and admin overhead. Today’s smart managers strengthen their positions (and reputations) by getting ahead on insulation, documentation, and tech-enabled compliance.

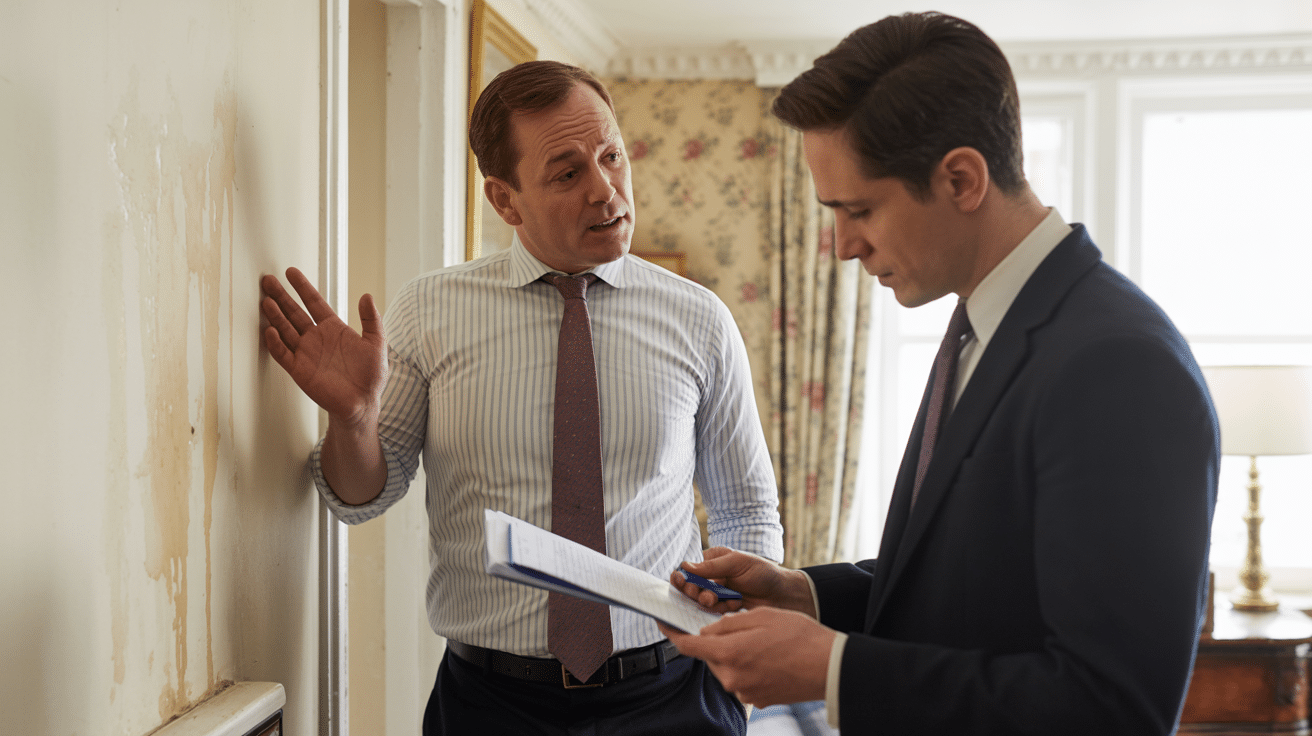

Step-by-Step: What Does a Fully Compliant Insulation Upgrade Look Like?

Let’s break the process down, so you know exactly what regulators, lenders, and even buyers now expect before a property gets the green light.

1. EPC Survey—Start Here

Book a surveyor who understands today’s Part L, MEES, and grant frameworks. Get a proper “fabric first” review—not just a boiler probe.

2. Detailed Insulation Audit

Verify existing depths and coverage, locate cold bridges/weak spots, and ensure any prior claims are proven (or flagged for re-do). Check documentation against installation.

3. Bring In Certified Pros

A PAS2030/TrustMark-registered installer is essential for anything that will ever be checked, sold or let. DIY saves “nothing” long-term if you lose compliance or grant access.

4. Correct Installation—No Compromise

Use manufacturer-backed or certifiable materials only. Apply to spec, with all thicknesses, types, and joints recorded. Don’t compress; don’t bodge corners. Get photographic records as you go.

5. Total Documentation

Log every change: keep U-value certificates, photo before/after, installer sign-off. Build a compliance folder—not for inspectors, but for your own futureproofing and rapid access.

6. Handover, EPC Update, and Asset Protection

After work, update your EPC and asset registers. Request a digital handover pack for letting, lender, or sale use later. With good insulation, upgrades pay off for decades—not just audits.

Insulation done right turns one job into decades of peace—no last-minute panic, no nasty surprises.

What’s the Real Return: Tangible Benefits for Owners, Landlords, and Agents?

Compliance is the price of admission, but insulation’s benefits are felt every day—in profits, reduced headaches, and long-term resilience.

- Higher Sale and Let Prices: EPC “A” and “B” homes now command 10–14% more and move 50% faster ([zoopla.co.uk](https://www.zoopla.co.uk/discover/property-news/epc-rating-affects-house-price/)).

- Happier Tenants, Lower Turnover: Proper insulation cuts cold, damp, and mould complaints by up to 70% ([shelter.org.uk](https://england.shelter.org.uk/housing_advice/repairs/mould_and_damp?utm_source=openai)), translating to better retention and lower business risk for managers.

- Cheaper Running Costs: Up to £540/year in “saved” energy isn’t theory, it’s happening in every properly insulated home. Across portfolios, that’s serious cash protection.

- Uninterrupted Access to Grants: From net zero to council-level schemes, up-to-date insulation and solid documentation unlock new funding and make properties stand out for improvement rounds.

- Lower Maintenance and Legal Costs: Fewer cold spots, less condensation, and healthier indoor air mean less call-out cost, happier tenants, and a stronger compliance safety net.

The right insulation futureproofs both asset value and stress-free management.

Property managers who systematise insulation documentation find audits pass on first try, repair costs drop, tenants churn less, and their brand reputation rises. Owners who “do it once” get returns for years; agents get a lettable, marketable asset with less last-minute fire-fighting.

Why Do Owners, Landlords, and Agents Rely on Plumbers 4U for Insulation Upgrades?

Let’s get down to brass tacks: in a market filled with quick fixes and bodged paperwork, the difference is in the detail, the certification, and the support.

Plumbers 4U has earned the trust of over 500,000 UK property holders for a reason:

- Zero-guesswork surveying: Every upgrade starts with a forensic review—no missed zones, no generic advice.

- Certified, standards-led execution: Only fully qualified WRAS, G3 and TrustMark engineers. This means legal sign-off, not just peace of mind.

- Audit-proof documentation: Each job comes with full U-value details, photo trails, and digital asset folders lined up for audits and asset registers.

- No hidden charges, ever: Transparent, all-in quotes with detailed breakdowns—so you know what’s covered, and what’s coming.

- Proactive aftercare and compliance: Ongoing reminders for EPC updates, guidance on the next legal landmarks, and support in unlocking grants and incentives.

It’s not just invisible, it’s invaluable—the insulation you don’t see delivers at every audit, every letting, every sale.

Our history is in safe, standards-led work. But our future—and yours—is about making your property audit-proof, resilient, market-winning, and ready for whatever new regulations land next.

Ready to Get Ahead? Book Your Certified Insulation Audit or Upgrade with Plumbers 4U

You could wait until stress (or penalties) pile up, or you can position yourself—now—as the owner, landlord, or manager who’s always audit-ready, never back-footed. With Plumbers 4U, you’re choosing more than a service—you’re choosing proven protection, higher value, happier tenants, and operational peace.

- Precision EPC and insulation surveys designed for compliance and asset protection:

- Upgrades performed by WRAS, G3, and TrustMark certified experts—no corners cut:

- Complete documentation pack—futureproof and ready for any audit, lender, or grant:

- Direct support line for managers, agents, and multi-property owners:

Book your insulation upgrade today. Defend your asset. Secure your future. With Plumbers 4U, it’s done once, done right, and done for whatever comes next.

Frequently Asked Questions

What silent liabilities arise if your property’s insulation doesn’t match the 2024 regulations?

Landlords, agents, and owners who let insulation compliance slip in 2024 court a new breed of risk: stalled sales, surprise voids, uninsured events, and sudden cash demands to “prove or redo” work. Enforcement has shifted from “fix it if you’re caught” to digital-first risk triage: lenders, councils, and insurers routinely cross-check insulation logs and U-values before releasing funds, renewing tenancies, or processing claims. Failing a single check isn’t just a paperwork hiccup—it stalls income and puts assets under a magnifying glass.

Miss one photo, certificate, or test result and decisions start happening about your property before you even get notified.

How do these liabilities show up in the real world?

- Lettings block: More than 40% of buy-to-let mortgage rejections in 2023 were due to absent or aged insulation evidence, even homes with visible upgrades.

- Uninsurable events: Major UK insurers now quiz renewal applicants on insulation materials, instal date, and depth. A missing PAS2030 record risks claims being denied and policies lapsing.

- Grant clawbacks: Retrofit grants from 2022 are being reclaimed if owners can’t document every element and batch—even for jobs done by the book.

- Council spot-check fines: Letting agents saw spot checks result in £2,000–£8,000 fines where a lost batch code or unlogged flat roof created formal non-compliance.

- Void escalation: Rental rights frozen instantly on reinspection or if a complaint flags missing paperwork, costing up to £1,800/month in lost revenue per property in London boroughs.

Insulation liability is no longer a case of “get it sorted next year.” Enforcement happens in a flash—triggered by ordinary queries from lenders, tenants, or local authorities. Reliable insulation compliance, with digitally traceable records, is now central to asset protection.

How does insulation tangibly impact property value, rentability, and running costs in today’s market?

Insulation acts as a force multiplier for property value, rent potential, and annual expense reduction. The 2024 property market ties not just price, but eligibility for finance and grants, directly to proven EPC uplift—mainly driven by insulation. Unlike upgrades you see, compliant insulation quietly raises your home’s EPC by a whole band (or more), turns “no” to “yes” when you remortgage or let, and can shave hundreds off yearly utility bills in a single go.

The homes attracting best tenants and strongest buyer interest in today’s listings are less about feature walls and more about verifiable insulation in roofs, walls, and underfoot.

What are the biggest wins from insulation upgrades?

- Sales premium: The “green uplift” in the UK has reached 10–15% over E/F-rated comparables, with AB-rated homes moving 30% faster on Rightmove.

- Tenant demand: Zoopla tracked tenants paying 12% higher rents (2023) for recently upgraded C-rated properties; comfort and savings drive demand.

- Running costs: Loft top-ups and cavity wall fills typically cut annual heating bills by £200–£400 in semi-detached or larger homes (Energy Saving Trust 2024).

- Grant gateway: Access to ECO4, Boiler Upgrade Scheme, and new local authority retrofit funds is almost always predicated on documented insulation.

- Fast-track re-letting: Letting agents report insulation upgrades reducing void periods by up to 40% as renters actively philtre for thermally efficient stock.

If improving ROI, market relevance, and cash flow are goals, insulation is the “invisible renovation” with maximum leverage in the current landscape.

What documentation and proof do you need for insulation to pass digital audit and unlock sale, letting, or grant approval?

Regulatory audits and lender checks hinge far less on what’s present in your walls and more on what’s visible in your folder. Compliance in 2024 means producing a faultless trail of certified, time-stamped, and batch-specified documentation—cross-checked by everyone from EPC assessors to council grant officers. If you only have “it looks insulated” and a builder’s invoice, doors begin to close fast.

A project that’s well insulated but poorly documented is treated as non-existent—missing paperwork turns upgrades into liabilities overnight.

What constitutes proof for a modern audit?

- Pre-and post-photos: High-res, time-stamped images showing depth (loft: ≥270 mm), consistent coverage, and batch labels for materials used.

- PAS2030 and TrustMark: Installers must provide certificates showing their credentials and explicit links to your project.

- Digital job log: Detailed installation notes, including labour names, scope of works, U-value calculations, and on-site checks uploaded to a cloud folder for lender or grant authority access.

- Material traceability: Keep product batch numbers and manufacturer certificates; some lenders verify lot numbers against approved materials lists.

- Upload to authority portals: Many councils and grant bodies now require proactive upload of evidence to their digital platforms, not just physical handover or file retention.

A missing document or photo—no matter how solid the instal—can result in failed audits, grant rejections, and (worse) withdrawal of previously secured funds.

Table: Insulation Audit-Ready Documentation

| Evidence Type | Required Detail | Reviewer/Purpose |

|---|---|---|

| Photo logs | Pre/post, depth, batch labels visible | Lenders, council, EPC |

| PAS2030/TrustMark certs | Explicitly tied to job, instal team | Grant audit, rental check |

| Batch/product certs | Manufacturer/lot for all materials | Council, lender, insurer |

| Digital instal log | Dates, names, scope, signed wayleave | Council, buyer, grant |

| EPC “completed” status | Matches new insulation | Lender, buyer, letting |

Why do genuinely “insulated” properties still get blocked by auditors, lenders, or grants?

A house can have layers of proper insulation yet still fail compliance or financing in 2024—usually because the evidence chain fails, not the installation. The audit bottleneck has shifted: digital oversight means that the data behind the work now matters more than the material. PAS2030, U-value, and TrustMark requirements become blocks when corners (even of paperwork) are cut.

When an EPC or council inspector asks prove it, the screen matters more than the joists.

Where do most fall down—despite honest upgrades?

- Lost or untraceable records: If the batch code, certificate, or photo log isn’t instantly accessible, compliance fails by default.

- Partial coverage: Even a small missed area—a flat roof, odd corner, or “I thought it was done”—can bring a full refit order.

- Unapproved material: Recent bans on certain foams or DIY kits mean that newly installed systems can be rendered non-compliant by policy.

- DIY or non-accredited instals: Unless the work logs a PAS2030/TrustMark ID, grants and most mortgage products are a non-starter.

- Audit mismatch: When the EPC or grant portal can’t reconcile what’s claimed with photos and serials, progress stalls and costs mount up.

Common Failure Points and Resulting Blocks

| Failure Reason | Effect/Outcome |

|---|---|

| No depth or batch photo | Grant or sale denied |

| Unapproved foam or material | Mortgage or insurance refusal |

| Installer not PAS2030/TrustMark | Audit fails, full trace demanded |

| Missing digital log | Council triggers reinspection |

| Gaps or partial fill | EPC or rental freeze, rework ordered |

Even high-quality upgrades are increasingly invisible without perfectly matched proof.

How will upcoming regulation, council audits, and green finance reshape insulation compliance—and who leads in delivering future-ready coverage?

UK regulation is moving fast: most lenders, local authorities, and grant bodies expect not “EPC E” but “C or above” as the practical bar after 2025. Audit regimes will only get more digital and less forgiving. The smartest providers, like Plumbers 4U, are already treating compliance not as an end, but as a changing target—wrapping every job in certification, infinite-documentation, and policy intelligence.

Tomorrow’s winners in property portfolios, management, and letting are those whose compliance stands up to digital audit twice as often and twice as fast.

What distinguishes a genuinely future-proof insulation specialist?

- PAS2030/TrustMark as entry, not premium: Any team missing digital-verified credentials is a risk no matter the cost.

- End-to-end documentation: Pre/post photos, batch logs, certificates, and cloud job reports supplied before payment.

- Active horizon scanning: Teams that automatically track regulation and subsidy updates protect your property’s eligibility—critical for landlords with 2025 looming.

- Audit-response readiness: Immediate provision of all data, from U-value proof to retroactive insurance queries, wins at council and lender check-in.

- Grant and finance enablement: Proven track record in maximising public subsidy, mortgage success, and grant application completeness.

Plumbers 4U has executed half a million compliant upgrades, with TrustMark and PAS2030 credentials across every project—delivering not just insulation, but a full digital “compliance pack.” That means you operate, sell, or let without rework, question, or risk of approval denial, regardless of incoming regulatory change. Get audit-ready, grant-accessing, insulation compliance by booking a photo-documented, cloud-delivered upgrade.

What step-by-step process ensures insulation work is bulletproof—regardless of property type, inspector, or funding?

Owners, landlords, and managers seeking a frictionless audit or grant journey should follow the example of a council-endorsed “future-proof” project. The gold standard is simple but rarely followed: plan, document, verify, retest, log, then hand over every kilo of evidence as digital kit—delivered before your next audit is ever triggered.

Audit-proof insulation isn’t won at the end, it’s decided step by step, and always finished in the file, not just the loft.

Essential Six-Step Compliance Process

- Pre-instal survey: Digital assessment of property via EPC and visual check, mapping zones for required U-value benchmarks (roof, wall, floor).

- Material approval: Secure only products with current PAS2030, TrustMark, or council buy-in; check manufacturing dates to avoid batch lapses.

- Installer certification: Assign only teams with active credentials—store proof up front, in both digital and physical files.

- Instal with evidence logging: Photograph and upload all stages—old material removal, depth measure, coverage, batch codes, and post-completion wide shots.

- Credentialed sign-off: Final works log signed by site supervisor, digital copy sent to the owner and uploaded to local authority/financier as precondition for final payment.

- Post-job verification: Independent inspector or EPC assessor reviews logs, crosschecks instal to survey, updates property EPC and revalidates digital compliance pack.

Table: Bulletproof Audit Sequence for Insulation

| Stage | Critical Action | Output |

|---|---|---|

| Pre-survey | EPC+visual map | Verified plan, gaps |

| Product approval | Check batch, compliance | Code-approved list |

| Certed instal team | Assign credential proof | File + digital copy |

| Evidence log | Photos, depth, label | Upload to drive |

| Supervisor sign-off | Job completion log | Dual (paper/cloud) |

| External validation | Pass/fail with notes | EPC/council update |

No matter your property profile, following this sequence makes audit or grant eligibility a process—not a roulette. Plumbers 4U offers direct assistance on every step, pairing clients with compliance advisors and digital kit so the next council call or buyer Q means opportunity, not panic.